Without an emergency fund, one would have no money except the money already being used to live off of to pay for the damages. This would prove to be a very sticky situation due to the fact that there is little else a person would be able to do besides spend money they don’t have and possibly go into a fair amount of debt.

Nobody wants that.

If only there was some way to prevent all of that. If only there was some form of, emergency money kept as a fund somewhere…

Perhaps, an emergency fund is the answer!

An emergency fund allows a lot more freedom to not get stuck financially in a bad situation.

The emergency fund allows a form of a sense of security. No worrying about leaving a relationship where the person bringing the money in is not oneself. Or if a current employment situation is just so unbearable that it just has to come to an end before another job opportunity arises.

The emergency fund is a financial breathing room.

“Keeping an emergency fund is always a great idea. You never know when the unexpected could happen to you,” Dylan Odri, a sophomore music industries major at Albright College, said. “I feel like keeping an emergency fund is something everyone should do.”

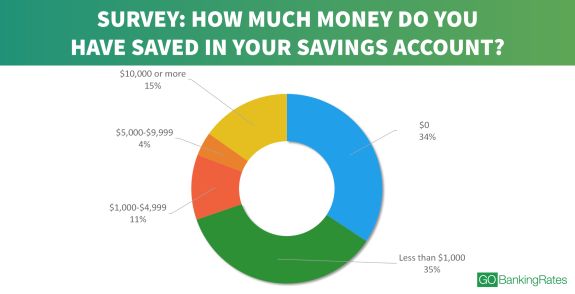

According to 2016 GOBankingRates survey it was found out that 69 percent of Americans have less than $1000 saved up in their total savings. The survey also found out that 34 percent have no money saved up at all.

Another thing to watch out for is what constitutes an emergency.

This can be kind of tricky due to the fact that this is entirely an opinion and it’s hard to say to a general population what could be considered a financial emergency.

Connor Ploski, a sophomore mechanical engineering major at Widener University, said, “I usually try to have one but it’s better when you have someone else help you hold it so you don’t use it to splurge on something.”

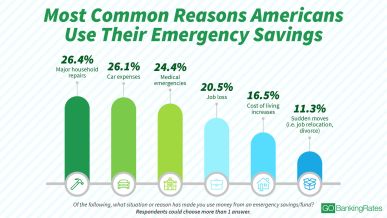

Something like for a home or car repair, a medical expense, or maybe just to keep afloat between jobs. It’s important to identify what isn’t an emergency. The best way to do that is if the expense is unexpected.

For those expected expenses though… a sinking fund could be very important.

“I read that you when you get a paycheck you should save the hundreds and make the rest last you as just as you can,” Liz Stolte, sophomore music composition and psychology major at Bucknell University said. “Like if you make $480 you put the $400 into saving and use the $80 as spending cash for two weeks”

Most people probably aren’t familiar with what a sinking fund is. The sinking fund is good for spending money on those expected expenses. For instance if you need to buy Christmas presents for relatives. This is why it’s really important to save money in different funds.

Without funds like these things can begin to spiral out of control.