Being a college student and a consumer, junior business management major Banesa Castaneda tends to use her debit card rather than cash to make everyday purchases most of the time. Living on campus, Castaneda usually goes on shopping sprees for groceries and meals along with day-to-day needs.

When carrying cash, she often feels hesitant to spend that money on unnecessary items; therefore she believes using her card is extremely important to keep track of what she purchases. For Banesa using a debit card rather than cash helps her to save money and use it wisely.

“When purchasing items, it is easy and convenient to simply pull out my card and swipe it against the card swiping machine instead of having to count the exact amount if I were to use cash to make a purchase,” Castaneda said.

Additionally, as a college student, she likes to be aware of what she is spending her money on. Castaneda sees using a card is a major benefit because she is able to have a detailed list of transactions made each month. Having an online account from her bank allows Castaneda to see where she is making purchases along with setting a budget for herself.

“When it comes to online shopping, using a card is a faster and a more reliable way to pay for the item,” Castaneda said.

A lot of Americans are relying more on debit and credit cards than cash. Almost all businesses give their customers the option to purchase goods either with cash or through a card. There are certain businesses that do require you to use cash only. In addition, there are now a growing number of businesses that don’t allow cash at all.

People sometimes prefer to use both depending on what they are purchasing. Online shopping has driven up the use of credit and debit cards. On Feb. 15th the Philadelphia City Council passed a bill to decrease the amount of business that are becoming “Card Only” businesses.

Councilman Bill Greenlee brought the issue to light. He believes having a business that only allows customers to use a card is discriminating against the poor because they cannot afford to have a card.

New technology has made it even easier to make in-store purchases. While credit cards are easy to use, the Apple iPhone lets you link your card to your phone and use what they call “Apple Pay.” Many companies installed Apple Pay at their check out counters. With programs like Apple Pay, you do not necessarily need to carry your card on you to make any purchases.

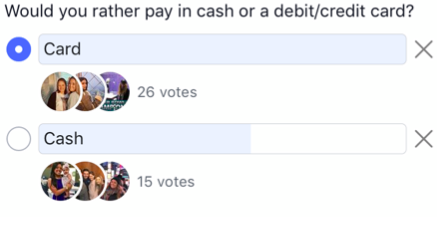

A poll on Cabrini’s class of 2020 Facebook page showed that 26 students and staff members prefer to use a card than cash. 15 students and staff members prefer to make daily purchases with cash than with a card. According to Pew Research, studies have shown that the percentage of Americans who purchase goods with cash has decreased six percent from 2018 to 2015. Today, 18 percent of Americans purchase good using cash on a weekly basis.

Within their research Pew found that using cash or card can also depend on age demographics. Research showed that Americans who are below the age of 50 are more likely to not make purchases with cash or have cash in hand.

Although the 21st century is more cash-free, there are businesses that prefer to see customers use cash more than a card.

Miguel Medrano, who was the owner of Union Grocery, a corner store in North Philadelphia, would be charged by the credit card company 75 cents for each purchase that was made with a card. Medrano has been the owner of the store for over three years.

While owning the store and working night shifts himself, he noticed that the customers relied on cash more. Most people would spend at his corner store was about $10-$15. He has a sign on the card reader that warned customers that they will be charged the extra 75 cents if they used their card.

“They hated the fact that they were charged extra,” Medrano said.

Restaurants, pizza shops, and nail salons give their customers the option to pay with cash or card. Typically in businesses like these, it is common the customers give the employees a certain percentage of the tip or what they can provide.

Early childhood education major Emily Hill is a waitress in Applebee’s’ Bar and Grill. Being a waitress she does not have a say as to how the customer wants to pay the tip either with cash or card. As servers, they have to check out at the end of the night. With the tips that they do earn by cash, they owe a certain amount of cash to the business. On top of that, they have to split the tips by three percent within the bartenders and hosts as well. When they get credit card tips it gets taken off of the cash total they owe to the business. At the end of the day, Hill prefers her customers to pay with a card and leave a cash tip.

“People normally tip with their card; it’s honestly surprising when people pull out cash,” Hill said.

Americans relying on physical currency decreased within the years. It is fair to say that in certain situations or for particular reasons people prefer to use cash rather than a card. Both cash and card have their pros and cons and the advanced technology has made it easier for Americans to not carry a full wallet around. All businesses in Philadelphia that are being forced to make it optional for customers to pay in cash or card will see a variety within their customers’ purchases from here on out. It is clear from the research that physical currency does not have the importance it used to 10 years ago but there are Americans who are unable to afford to put their money on a card.