A struggle many people who are trying to eat healthy face is that the price of healthy food is typically higher than foods loaded with sugar, salt and fats. For example, it is cheaper to buy a soda and bag of chips for lunch than it would be to purchase a salad.

In early 2017, Philadelphia introduced a 1.5 cents-per-ounce soda tax on sugar-filled beverages such as soda, energy drinks and iced teas in hopes of encouraging residents to make healthier beverage choices.

The new tax goes to raising money for local school districts. Few communities are also trying this tactic, but many communities are still debating the issue.

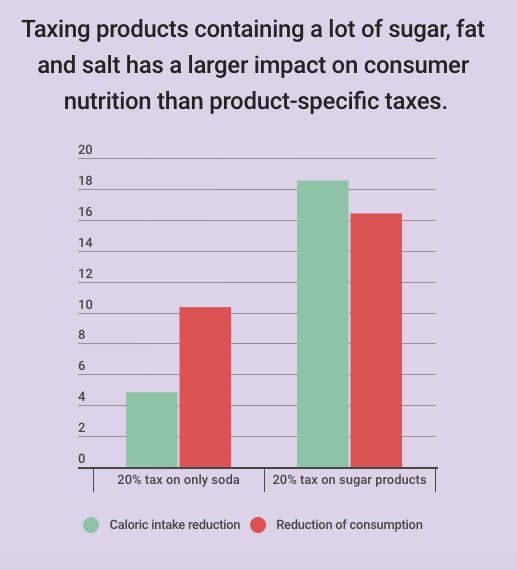

The question is: does taxing only soda really discourage consumption? A new study looks at whether taxing all sugar, fat or salt-filled products might be a more effective way to get people to cut back on unhealthy foods than just taxing specific products.

A study done by Matthew Harding of the University of California-Irvine and Michael Lovenheim of Cornell University examined how higher prices can affect food-buying habits and personal nutrition. The authors simulated a 20 percent tax on not just soda and other sugary beverages but also products that contained a large amount of sugar, fat and salt for comparison.

The study analyzed over 123 million food-purchase transactions from a variety of stores in 52 geographic markets between 2002 and 2007. The study concluded that higher-income households buy more fruits, vegetables, snacks, candy and packaged meals while lower-income households buy more soda, meat and milk.

“Sugar taxes are especially effective at encouraging healthier purchases,” Harding said in his research. “Sugar, in particular, is highly prevalent in American foods. Taxing these nutrients does not allow consumers to substitute to other goods that also contain these nutrients. Rather, they shift to healthier products and decrease overall consumption.”

The research makes it clear that a sugar tax would be more effective than a soda tax. Taxing all products that are high in sugar, fat and salt is addressing the whole issue of consumers purchasing unhealthy food options rather than just taxing soda, which is only a fraction of the problem.

Taxing sugar would be a wise decision. Not only is the tax helping the community, it is also encouraging people to think twice before purchasing something that is harmful to their health and can lead to obesity and other health-related issues.

As long as the added tax on sugary beverages and snacks is going towards Philadelphia school systems and benefiting product consumers, then by all means, keep on taxing.