College.

What an interesting time in a young person’s life. Are they an adult? Are they a kid? More-so, it is a middle ground of the two.

As a college-aged student, it is a tough balance of being totally independent and still needing to lean on parents.

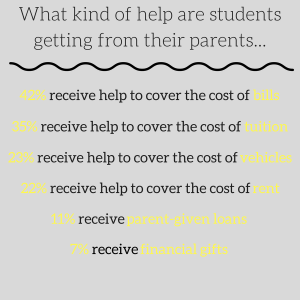

Most of this difficulty stems from the issue of money. Students need it and there is not enough of it. Everything costs money. From food and supplies to entertainment and textbooks, college students always have expenses knocking on their door.

In this age, it is hard to make a living to pay for housing, food, necessities and education costs. It is nearly impossible. Sure, loans can be taken out and stick to the student like a shadow for years to come but, more often than not, those cause greater financial hardships down the road.

So, where else do students turn but to their parents?

People often call this seek for help and guidance taking a trip the bank of mom and dad. But, not all mom and dad “banks” operate the same.

From freshmen to seniors, every student handles their finances and monetary needs differently. And, as students climb the ladder of age, they figure out more and more how to handle their own money.

“Since my parents are separated they both give me a certain amount each month,” freshman business management major Grant Murray said. “They give me additional money because they know I like to save my money, so I can build a savings account while still being able to go do things.”

Other parents in the Cabrini community have different approaches.

“[My parents] usually do not give me spending money because they expect me to be able to save money for spending and for things I really need,” sophomore elementary education major Marykate Keenan said. “My mom and dad did ‘fund’ me before college, but they want me to know how to save money so I can fund myself.”

Neither way is right and neither way is wrong. It is all about what works for the families.

Seniors have a little bit more experience navigating through college and finances as they embark on the real world.

“I have learned how to save my money and not spend it on unimportant things. I save my money for rent, utilities and my car before spending my money on other things,” senior elementary and special education major Maureen Sullivan said.

Sullivan’s parents provide her money for groceries, rent and tuition.

“My parents have three other kids at home to take care of,” Sullivan said. “I can make my money on my own, but my parents are reasonable and understand that college students cannot pay for college on their own with no help.”

No matter what the situation, students going through college need financial guidance and assistance.

So, is getting help from “the bank of mom and dad” really that bad?